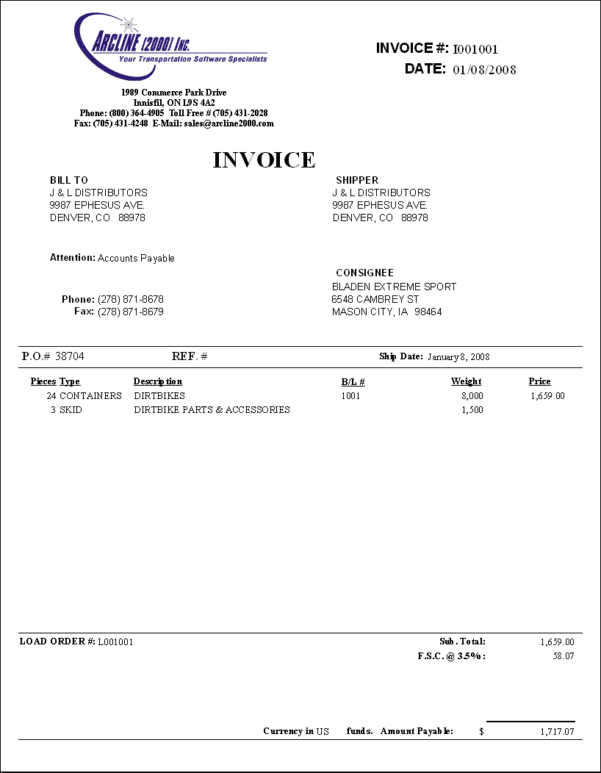

True sale factoring offers the benefits of a traditional revolving line of credit but with the flexibility of no financial covenants and the added advantage of non-recourse credit protection. Many large companies with existing senior lender relationships are seeking to unlock working capital in their receivables as a way to improve cash flow without taking on additional debt. The need for liquidity is driving greater demand for off-balance sheet financing solutions. Once a load is hauled, send a copy of your freight invoice to the factoring company. They get this money by charging a fee for factoring invoices. Basically, factoring is a cash advance on your outstanding freight invoices. Stop waiting 30, 60, or even 90 days to get paid and take control of your cash flow today with ENGS’ Factoring solution. Invoice factoring companies have to make money to pay their staff.

Freight invoice factoring full#

Our full recourse program provides the greatest flexibility, or, choose our non-recourse option for the added peace of mind that comes with credit protection. These rates are a percentage and can fall into a range of 1 with the best freight. They get this money by charging a fee for factoring invoices.

You Do Pay a Small Fee Invoice factoring companies have to make money to pay their staff.

Most Factoring transactions are straightforward and completed in two phases. While this tool is not a small business loan, it does involve selling your company invoices at a discounted rate. Companies that factor with ENGS also have the added benefit of expert back office support including credit recommendations, receivables management and more. There are many pros to freight factoring, but people tend to want to hear the negatives first. Freight invoice factoring is a financing instrument that supplies your company with up-front capital by factoring invoices. ENGS’ factoring program focuses approvals on your customer’s ability to pay for the invoices generated instead of your business’ credit or financial performance. Factoring allows a business to accelerate cash flow by selling commercial accounts receivable in exchange a for a small discount.

0 kommentar(er)

0 kommentar(er)